Research Report | My Country’s Charging Infrastructure Business Model and Development Trends

Research Report | My Country’s Charging Infrastructure Business Model and Development Trends

My country’s charging infrastructure business model and development trends

Wu Mengyao, China Energy Security New Strategy Research Institute

As an energy supply facility for electric vehicles, the domestic charging infrastructure industry has been accelerating in recent years under the dual promotion of policies and markets. Especially during the “Thirteenth Five-Year Plan” period, under the active guidance of national policies, my country’s electric vehicle charging infrastructure construction has entered a stage of rapid development. At present, my country has become the market with the largest scale of electric vehicle charging infrastructure construction.

The latest data shows that as of August 2023, the cumulative number of charging infrastructure nationwide has reached 7.208 million units, a year-on-year increase of 67%, showing continued rapid growth. With the active guidance of national policies, continued investment of social capital, and the continued expansion of the electric vehicle market, my country’s electric vehicle charging facility system will continue to be improved in the future. In particular, the public charging service market is expected to enter a mature stage during the “15th Five-Year Plan”.

1. Overview of the development of electric vehicle charging infrastructure

1. Development history of electric vehicle charging infrastructure in my country

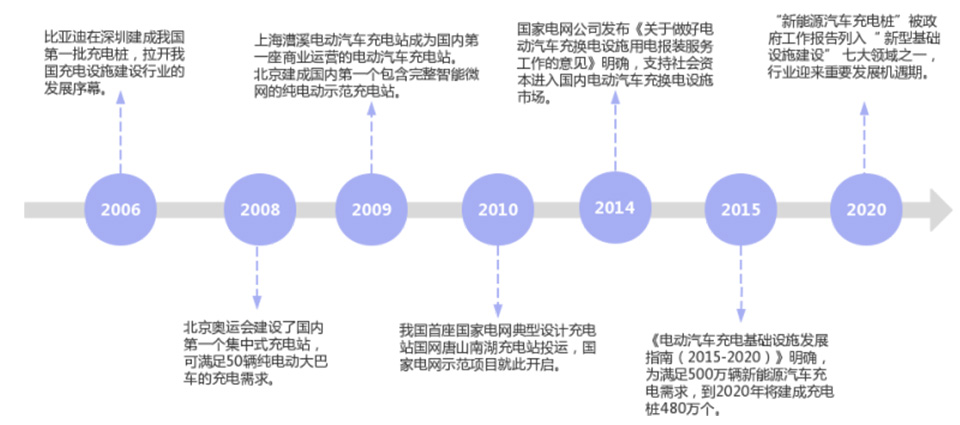

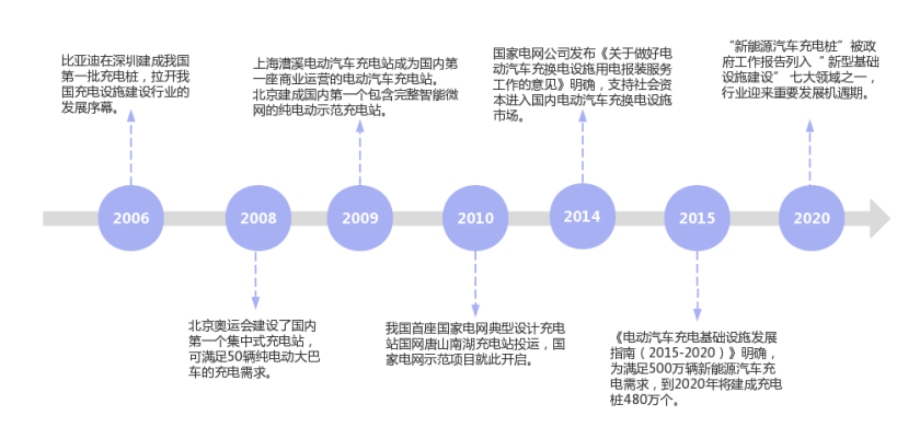

In 2006, BYD built my country’s first batch of electric vehicle charging piles in Shenzhen, kicking off the construction of my country’s electric vehicle charging infrastructure. In the early stages of development, due to the relatively small scale of the downstream electric vehicle market and insufficient driving force for industry development, my country’s charging infrastructure industry developed slowly, with relatively few construction and operating entities, and the number of charging piles grew slowly.

Data source: Compiled based on public information

Figure 1 The development history of electric vehicle charging piles in my country

Until 2014, the charging infrastructure industry ushered in double benefits, and industry development showed significant growth. In May, the State Grid Corporation of China issued the “Opinions on Providing Telephone Installation Services for Electric Vehicle Charging and Swapping Facilities”, which clearly supports the participation of social capital in the market for various electric vehicle charging and swapping facilities such as slow charging and fast charging. In November, four departments including the Ministry of Finance jointly issued the “Notice on Incentives for the Construction of New Energy Vehicle Charging Facilities” stating that the central government plans to allocate funds to provide incentives for the construction of charging facilities in cities or urban agglomerations that promote new energy vehicles. These two important documents take multiple measures in terms of finance, capital, and grid connection to inject vitality into the development of the electric vehicle charging infrastructure market.

In 2015, the charging infrastructure industry received two important policy supports. In October, the General Office of the State Council issued the “Guiding Opinions on Accelerating the Construction of Electric Vehicle Charging Infrastructure”, which clearly stated that it will strive to basically build a moderately advanced, vehicle-pile-equipped, intelligent and efficient charging infrastructure system by 2020 to meet the needs of more than 5 million electric vehicles. The charging needs of cars anchor the direction of industry development. In the same month, the National Development and Reform Commission, the National Energy Administration and other four departments jointly issued the “Guidelines for the Development of Electric Vehicle Charging Infrastructure (2015-2020)” stating that in order to meet the charging needs of 5 million new energy vehicles, 480 charging piles will be built by 2020. Ten thousand, once again establishing the direction for the development of the industry.

During the “Thirteenth Five-Year Plan” period, thanks to my country’s vigorous promotion of the development of the new energy vehicle industry, the sales volume of electric vehicles has achieved rapid growth, the market size has significantly expanded, and it has significantly stimulated the development of the charging facilities industry. At the same time, the shift in government subsidies from “new energy vehicle subsidies” to “charging facility construction subsidies” to “charging facility construction subsidies + charging facility operation subsidies” has also provided strong support for the development of the charging facility industry, driving The industry as a whole has entered a stage of rapid development. Especially in 2020, “new energy vehicle charging piles” were officially included in the government work report as one of the seven major areas of “new infrastructure construction”, marking the rise of charging infrastructure from supporting facilities for electric vehicles to an important part of my country’s economic and social development. With new infrastructure, industry development is ushering in a period of important opportunities.

Since the “14th Five-Year Plan”, as the “double carbon” work continues to deepen, the State Council and relevant departments have successively promoted the solid implementation of a series of policies to support the development of the charging infrastructure industry, guiding the industry to continue to accelerate development.

On January 21, 2022, the National Development and Reform Commission, the National Energy Administration and other ten departments jointly issued the “Implementation Opinions on Further Improving the Service Guarantee Capacity of Electric Vehicle Charging Infrastructure”. It is clear that by the end of the “14th Five-Year Plan”, my country will have formed a moderately advanced, a balanced, intelligent and efficient charging infrastructure system that can meet the charging needs of more than 20 million electric vehicles. In August of the same year, the State Council executive meeting made it clear that the construction of charging piles should be vigorously promoted and included in the scope of support from policy-based development financial instruments. On April 28, 2023, the Political Bureau meeting of the Central Committee mentioned for the first time that the development of charging piles should be included in the new energy infrastructure sequence, demonstrating the country’s determination to promote the development of charging infrastructure.

On May 5, 2023, the National Development and Reform Commission and the National Energy Administration jointly issued the “Implementation Opinions on Accelerating the Construction of Charging Infrastructure to Better Support New Energy Vehicles Going to the Rural Areas and Rural Revitalization” which clearly stated that support for the construction and operation of charging networks will be increased. , by 2030, demand (capacity) electricity charges will be waived for centralized charging and swapping facilities that implement a two-part electricity price system, further stimulating the enthusiasm of charging pile operators and attracting more social capital.

2. Our country has formed the largest number of Charging infrastructure system with the widest service scope and most complete types

After more than ten years of development, my country’s charging infrastructure construction has grown from hundreds of thousands of units in the early days of the “Thirteenth Five-Year Plan” to more than 7 million units. Now it has formed the world’s largest charging infrastructure with the widest range of services and the most comprehensive types. infrastructure system.

1. The types of charging facilities are becoming increasingly abundant.

According to different technical routes, my country’s electric vehicle charging infrastructure can be mainly divided into two modes: charging and battery swapping.

Table 1 Comparison of mainstream charging modes

| Type | Advantage | Shortcoming | Installation Location |

| AC charging pile “Slow charging” | Simple structure The device is small and easy to install The most mature technology Lower installation costs | Charging power is low (mostly 7 kilowatts), Long charging time (6 to 8 hours) | More suitable for scenarios that are highly sensitive to electricity prices and do not care about charging time, such as residential areas, office buildings, etc. |

| DC charging pile “Quick charge” | High charging power (up to 60 kilowatts); Short charging time (30 to 120 minutes) | The structure is more complex; The equipment is large in size and occupies a large area; High technical requirements; High cost | More suitable for scenarios with high charging time requirements, such as operating vehicle charging stations, shopping mall parking lots, etc. |

| Battery swap mode | Short energy replenishment time and high efficiency | Charging stations have large power supply capacity and high investment costs; Requires professional maintenance and high daily operating costs; Battery standards must be unified |

Charging mode is currently the more mainstream way of replenishing energy. According to different charging technologies, it can be mainly divided into three types: AC charging, DC charging, and wireless charging. Among them, AC charging and DC charging technologies are relatively mature and have entered the marketization stage; wireless charging mainly includes three modes: electromagnetic induction, radio wave, and magnetic field resonance. Restricted by technical specifications and business models, all are currently being explored. In the application stage, it is necessary to further mature the technology and continue to reduce costs before large-scale application is possible.

The battery swapping mode refers to the centralized storage, centralized charging, and unified distribution of batteries through centralized charging stations, and replenishing power by directly replacing battery packs for electric vehicles in the battery distribution station. It can generally be divided into passenger car battery swapping stations. There are two types: commercial vehicle battery swap stations. Thanks to the significantly shortened energy replenishment time and higher energy replenishment efficiency, its market share has been rapidly increasing in recent years.

From the perspective of participating entities, market entities in the battery swap model can be mainly divided into four categories. The first category is new energy vehicle manufacturers, represented by NIO and Geely Group; the second category is power battery manufacturers, represented by CATL; the third category is energy suppliers, represented by State Grid and China Southern Power Grid; The fourth category is third-party power exchange operators, represented by GCL Nengke and Aodong New Energy.

Currently, the key to realizing large-scale commercial application of the battery swap model lies in battery standardization and shared battery swap. Due to the differences in design, materials, and uses of power batteries of different brands, the batteries are not unified in terms of power, sockets, etc., which has become the biggest obstacle to the large-scale application of the battery swap mode.

2. my country’s public charging facilities are mainly concentrated in more economically developed areas.

From the perspective of distribution area, my country’s charging facilities construction area is highly concentrated, mainly distributed in more economically developed areas.

Especially for public charging facilities, the uneven distribution is even more obvious. Data shows that as of the end of 2022, the cumulative number of public charging piles in Guangdong, Zhejiang, Jiangsu, Shanghai, Hubei, Beijing, Shandong, Anhui, Henan, and Fujian ranks among the top ten in the country, accounting for a total of 71.3% of the country.

There are multiple reasons why this happens. First of all, in the development of the charging infrastructure industry, some companies simply “build piles for the sake of building piles” in order to obtain more subsidies. They only pursue the growth of the number of charging piles and do not care about the location of the construction. Some charging stations have even been chosen. The corners of the clear route cannot be marked on the map; at the same time, in order to save costs, some operators will mainly use slow charging AC piles when selecting charging pile types. As a result, these charging piles are less competitive in the current market and the single pile utilization rate is lower. Low or even become a “zombie pile”.

Secondly, the layout of public charging piles in some cities is too closely related to the travel radius and travel needs of residents, resulting in charging piles being highly concentrated in areas with more developed businesses and denser populations, while the construction situation on highways or non-city central areas is difficult. meet demand and cause regional structural imbalances. This structural imbalance is particularly obvious in highway charging piles. According to data from the Ministry of Transport, as of the end of June this year, 5,931 expressway service areas across the country have covered charging facilities, accounting for 89.48% of the total number of expressway service areas; a total of 18,600 charging piles have been built, covering 29,000 small passenger car parking spaces. , and 27,000 parking spaces are reserved for construction and installation. The coverage rate of highway charging infrastructure in 17 provinces including Beijing, Hebei, and Liaoning exceeds 90%.

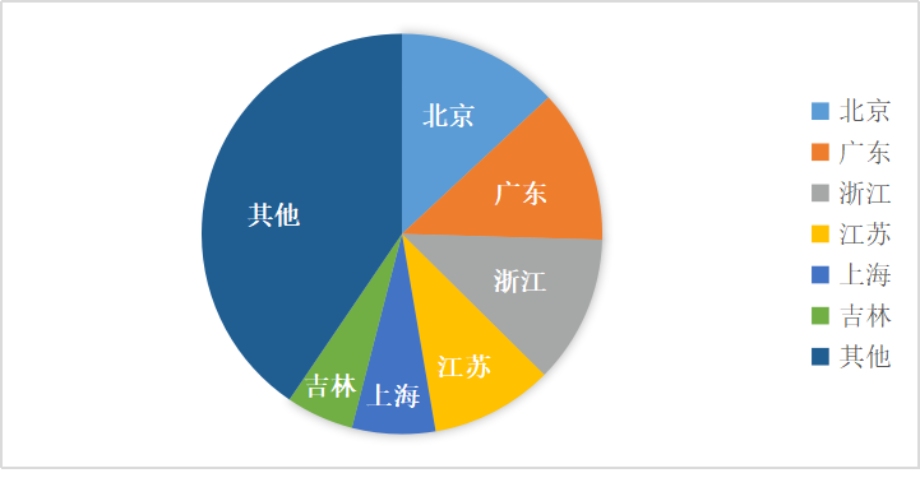

The market distribution of battery swap stations presents the same situation. my country’s power exchange facilities are mainly distributed in more economically developed areas, and the number of power exchange facilities in Beijing, Zhejiang, and Guangdong is far ahead in the country. According to data released by the China Electric Vehicle Charging Infrastructure Promotion Alliance, as of the end of June 2023, the number of battery swap stations in Beijing, Guangdong, and Zhejiang were 296, 281, and 271 respectively. Jiangsu, which ranked fourth, had 224 battery swap stations, ranking second. Shanghai and Jilin, which ranked fifth and sixth, dropped sharply to 152 and 124 respectively.

Data source: China Electric Vehicle Charging Infrastructure Promotion Alliance

Figure 2 Distribution map of battery swap station construction in my country (as of the end of June 2023)

According to agency forecasts, by 2025, the number of new energy vehicles in my country is expected to increase to 32.24 million, and the number of charging piles is expected to increase to 14.66 million, which is almost equivalent to doubling the current scale. At the same time, the scale of my country’s charging infrastructure market will reach 124.1 billion yuan, 134.7 billion yuan, 148.2 billion yuan, and 204.5 billion yuan respectively from 2022 to 2025. The market development prospects are broad.

The construction of public charging infrastructure in rural areas has seriously lagged behind, and has become an urgent problem for industry development. Data show that currently, the total number of public piles below the county level is approximately 221,000, accounting for only 9.45% of the total number of public piles nationwide, and the overall number is small. The reason is mainly because the current charging infrastructure industry in rural areas is still in its early stages of development. Most electric car owners in rural areas rely on “car-mounted piles” to replenish energy at 220 kV sockets in nearby public places or at home, which is enough to meet their needs. When the driving radius is relatively certain, even long-term use of private charging piles for slow charging will not affect the car experience, making it difficult for public charging piles to expand the market, and even daily operation and maintenance is difficult to guarantee.

Even in Zhejiang Province, which ranks at the forefront of the country in terms of economic development and new energy vehicle penetration rate, the construction of public charging piles is also highly concentrated in cities and along highways, and the market distribution is very unbalanced. Data shows that as of June 2023, Zhejiang Province has built a total of 9,691 charging and swapping stations of various types and 93,320 charging piles, ranking third in the country in total. However, there are about 13,000 charging piles in rural areas, accounting for only 10% of the total in the province. The total proportion is 14%, which is significantly different from the 26.6% of the population in rural Zhejiang.

In order to coordinate the promotion of charging infrastructure and new energy vehicles going to the countryside, Zhejiang Province issued the “Zhejiang Province Action Plan to Improve High-Quality Charging Infrastructure Network System and Promote New Energy Vehicles Going to the Rural Areas (2023-2025)” which clarifies that by 2025, all The province has built a total of more than 2.3 million charging piles, with no less than 900,000 in rural areas, meeting the charging needs of more than 4 million new energy vehicles. Among them, 120,000 public charging piles have been built, with no less than 20,000 in rural areas. The “Zhejiang model” of new energy vehicles going to the countryside with smooth travel across the province, full life cycle service management, and rich scenarios.

2. Operation model of electric vehicle charging facilities

1. Diversification of operating entities

Generally speaking, charging facilities involve multiple entities such as charging equipment manufacturers, charging construction operators, and overall solution providers from construction to operation. In order to improve profitability and expand business scope, in recent years, companies in a single link of the industrial chain have mostly extended their business scope upstream and downstream, breaking through development limitations and forming more business operation models by building brand ecosystems.

After years of exploration, currently, the commercial operation of charging facilities in my country has gradually formed three relatively mature development models, which are dominated by charging operators, dominated by car companies, and dominated by third-party charging service platforms.

1. Charging operator-led model

The operator model is an operation and management model in which charging operators independently complete the investment, construction, operation and maintenance of charging pile business, and provide charging services to users. It is the mainstream model in the current domestic market. The main types are public charging piles and dedicated charging piles. Representative companies include Telaidian, State Grid, Star Charging, Yiwei Energy, etc.

The construction of charging facilities is an asset-heavy operation, which puts forward high requirements on the financial strength and operational strength of enterprises. Generally speaking, charging operators must have relatively strong capital and be able to afford large-scale initial investments in venues, charging equipment, etc. At the same time, operators need to integrate upstream and downstream resources in the industry chain and collaboratively participate in charging technology research and development and equipment manufacturing, which can accelerate the construction of public charging infrastructure networks to a certain extent.

The shortcomings of this model are also more obvious in comparison. First of all, there are conflicts of interest among operators, which makes it difficult to share data and form information islands. The utilization rate of charging piles is not high, and the overall profitability is affected. Secondly, as an asset-based charging operator, the operating entities of this model mostly focus on the operation of its own charging-related assets, and have relatively poor refined operation and management capabilities.

2. Car company-led model

The car company-led model is an operating model in which electric car companies are responsible for the construction, operation and maintenance of charging infrastructure, and provide charging piles as after-sales services to car owners to improve car owners’ charging and car use experience. Under this model, relatively mature car companies can not only provide car owners with a better charging experience, but also effectively enhance their ability to control the market by creating a closed-loop ecosystem of the brand, and have a certain boost in the sales of new energy vehicles. function, thereby extending the industrial chain and enhancing the value chain. The main models dominated by car companies include two models: independent construction of piles by car companies and cooperative construction of piles. Representative companies include Tesla, NIO, etc.

Currently, Tesla and NIO, which are relatively large companies, insist on adopting the self-built pile model for their charging stations. Charging services are only open to their own car owners. They have a single customer group and a relatively limited service scope. They basically have no competitive advantage in the open market.

From a commercial operation perspective, the car company’s independent pile construction model requires car companies to invest a lot of costs in the construction and later maintenance of charging piles. However, the current source of income from charging piles is relatively thin, so it has a negative impact on the brand’s number of car owners, financial strength, and There are high requirements for operational capabilities. Therefore, the purpose of electric vehicle companies operating under this model is to form a brand service ecosystem, not to achieve profitability as the first goal.

The cooperative pile construction model is relatively open. Car companies provide customer groups, and operators provide energy and technology. This not only helps realize the interconnection of vehicle pile information and data, but also helps provide more information value-added services and increase revenue capabilities. , to achieve continuous improvement in market share, representative companies include the charging ecological model jointly built by WM Motor and Teledian.

3. Dominant model of third-party charging service platform

Different from the previous two models, third-party charging service platforms do not directly participate in the investment and construction of charging piles. Instead, they mostly invite major operators to connect charging piles to their own SaaS[1] platforms through resource integration. B/C customers provide solutions and provide business value based on intelligent management, mostly asset-light operations. This model can significantly improve the utilization rate of a single pile, achieve optimal allocation of charging resources, and increase project profitability. Representative companies include Xiaoju Charging, Cloud Fast Charging, and eCharging Network.

As a brand aggregation, this model has traffic advantages that are difficult to replicate with other models, can attract more car owners to the greatest extent, and achieve interconnection with different operators. At the same time, some companies with large market shares are expected to expand from charging a single charging service fee to wholesale electricity sales, and continue to expand their business scope. Some people in the industry believe that the business model dominated by third-party charging service providers can provide one-stop services throughout the life cycle and is expected to become the mainstream of the market in the future.

The disadvantages of this model are also very prominent. Since multiple brands are located in the same venue, the conflict of interest between brands is very obvious. At the same time, the platform has strong stickiness to operators with large market scale and high brand influence. If the leading operators with a large market share stop cooperation, sometimes the entire site and even the platform will lose market competitiveness or even be closed down.

4. Other modes

In addition to the three mainstream charging pile business models, there are currently a variety of operating models in my country, but the market size is still relatively small and only occupy a certain scale in specific regions.

For example, the crowdfunding pile construction model integrates social-related resources to the greatest extent through the method of “investors + charging service operators + site resource parties”, and multiple entities jointly share the initial investment and later operating costs. This model helps to revitalize the upstream and downstream industrial resources of charging piles and improve operators’ asset-heavy operational difficulties.

At present, the State Grid Corporation of China has obvious advantages in this model thanks to its strong strength in electricity, capital, etc. Brands such as Star Charging and Xpeng Motors are also gradually taking steps to explore under this model.

Star Charging clearly stated on its official website that entities willing to join do not need to pay franchise fees or distribution fees. The conditions for building a website and joining the franchise are that you need to have industrial land or commercial land that can be held for 5 years or more and a residual power of no less than 500 kilowatts or 1,000 amps, and be responsible for the daily equipment management, parking space management, and vehicle personnel management offline. Such work can be regarded as a specific plan for the crowdfunding pile construction model.

2. High initial investment and long recovery cycle, Industry profitability is generally high

Depending on the installation location, charging piles can generally be divided into public charging piles, dedicated charging piles and private charging piles. Generally speaking, only public charging piles involve profitability, and this area is also the focus of this discussion. At present, my country’s public charging pile industry has prominent problems such as high initial investment costs and long investment recovery cycles, and the profitability of industry operations is not high.

According to industry estimates, the current investment cost per kilowatt of building a charging facility is about 3,000 to 5,000 yuan, and the investment in a large-scale charging station generally reaches one million yuan. Such a huge initial investment makes the construction of charging facilities an out-and-out asset-heavy operation industry.

Table 2 Comparison of investment costs of charging power stations of different sizes (unit: 10,000 yuan)

Note: The calculation standard for this table is that the scale of a small charging station is about 5 40 kW DC charging piles or 50 7 kW AC charging piles, and the scale of a large charging station is about 30 40 kW DC charging piles or 30 7 kW AC charging piles. pile.

Data source: “Electrical Technology and Economics”

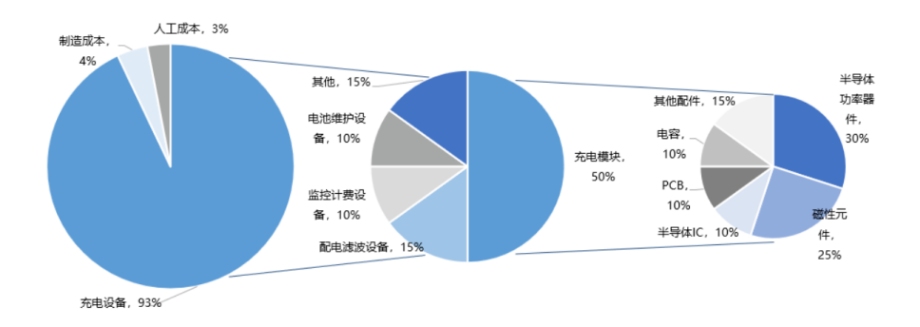

From a structural point of view, charging pile hardware equipment generally includes charging modules, power distribution filtering equipment, monitoring and billing equipment, and battery maintenance equipment. The cost of this part accounts for up to 93% of the entire cost structure of charging piles, while the cost of charging modules It is the most important expenditure on charging pile hardware equipment, accounting for about 45% to 55%. At present, my country’s most core component IGBT in charging modules still mainly relies on imports, further increasing construction costs.

Image source: “China New Energy Vehicle Industry Development Report”

Figure 3 Cost structure of 120kW DC charging pile

From the perspective of profit methods, at present, the revenue of public charging piles in my country mainly consists of charging service fees, parking fees, financial subsidies, value-added services, etc. Among them, charging service fees are the most basic way of making profits, and the utilization rate of a single pile determines profitability. key factors.

The low utilization rate of charging piles is an important reason affecting the income of public charging piles in my country. According to data released by the China Electric Vehicle Charging Infrastructure Promotion Alliance, as of 2022, the average utilization rate of public charging piles in my country is only 3% to 5%, the average utilization rate of urban charging piles is less than 10%, and the average utilization rate of highway charging piles The average utilization rate is less than 1%. Analysis of the reasons mainly comes from two aspects. First, the standards for charging piles are not unified, resulting in the inability to interconnect and interoperate electric vehicles and charging piles of different brands and manufacturers, resulting in prominent compatibility issues. Secondly, the driving radius of cities is relatively small, and the charging frequency of electric vehicles is not high. However, charging piles built in remote suburbs will be difficult to attract car owners to charge because they are too remote, which also leads to low utilization rates. The superposition of multiple factors makes the utilization rate of public charging piles difficult to meet expectations.

In recent years, participating in demand-side response as part of a virtual power plant to obtain grid interactive income has also begun to become a way for charging stations to increase their income. The virtual power plant uses the energy Internet to integrate charging piles, energy storage and other resources on the power load side that are scattered everywhere. By reducing its power consumption during periods of tight power supply, it forms a power supply with a certain scale and adjustable load resources. Coordinate the management system to achieve load regulation within a specific period of time.

Take Shenzhen as an example. In December 2021, Shenzhen launched China’s first integrated grid-ground virtual power plant operation and management platform. As of the end of June 2023, nearly 18,000 charging piles were connected to the Shenzhen Virtual Power Plant Management Center. After being connected to the virtual power plant, the vacant charging piles will immediately participate in peak shaving according to the grid instructions and obtain corresponding benefits. The response speed can reach the minute level; the charging piles in use will be decided by the car owner whether they are willing to perform peak shaving. If If you accept, the charging power will be reduced and the charging time will be increased by about 30 minutes, but you can enjoy a certain discount on the charging fee.

It is predicted that by 2025, the battery power of Shenzhen’s electric vehicles is expected to reach 50 million kilowatt hours. If this power can be effectively utilized, it will provide positive help for local clean energy consumption and power grid peak shaving and valley filling. At the same time, the construction cost of a virtual power plant is only one-tenth of that of a traditional power plant. By gathering dispersed resources on the power demand side to interact with the power grid, it can not only alleviate the tight power supply and demand, but also effectively save a large amount of money from traditional power plants and the power grid. Invest and allow participating users to receive certain rewards.

On August 26, 2022, Telaidian New Energy Co., Ltd. (hereinafter referred to as “Telaidian”), as one of the first 14 load aggregators, accessed the Shenzhen Virtual Power Plant Management Center, the first virtual power plant management center in China. From January to June 2023, by participating in energy management services such as economic dispatch, load constraints, peak shaving auxiliary services, and demand side response, TDL participated in more than 70 million kilowatt-hours of electricity, which is almost the same as the entire year of 2022.

It is understood that from 2019 to 2021, Te Laidian’s electric vehicle charging pile business was in a state of long-term losses as a whole. According to incomplete statistics, if government subsidies are not included, Te Laidian’s cumulative losses reached 560 million yuan in three years.

By participating in virtual power plant demand response, Telaidian has achieved a significant increase in profitability. Among them, during the peak period of electricity consumption from July 26 to 28, 2022, Telaidian met nearly 40% of its peak load demand during the demand response period of Shanghai. According to the subsidy standard of 6 yuan per kilowatt hour, the 3-day The subsidy income is approximately 15 times the charging service fee.

As of the end of June 2023, Telaidian has been connected with 20 networks, provincial and prefecture-level power regulation centers or demand-side management centers. The dispatchable resource capacity with virtual power plant conditions exceeds 3 million kilowatts, effectively realizing the integration between enterprises and local governments. win-win development.

According to industry estimates, currently, due to differences in standards such as site rentals and charging service fees in different regions, the investment return period for domestic operating charging piles is approximately 5.7 to 9.5 years. It can be said that it is difficult for investors to realize the rapid recovery of investment costs in the short term.

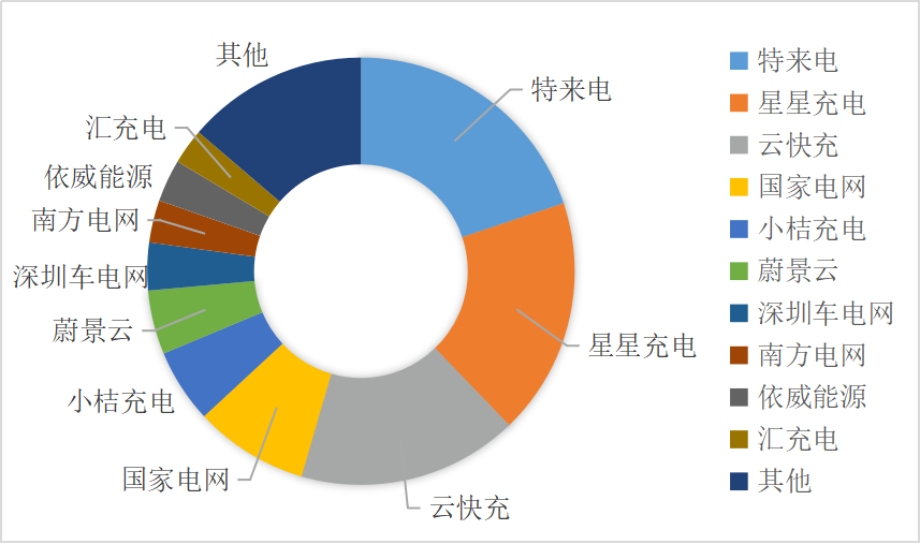

3. Operators are highly concentrated, and the Matthew effect in industry development is obvious

Although the diversification of operating entities is obvious, from the perspective of market share, the market concentration of my country’s electric vehicle charging infrastructure construction is relatively high. According to a survey conducted in 2020, among the more than 300 charging operators on the market at that time, only 15 operated more than 1,000 charging piles. The market was dominated by a small number of leading companies and had the say in the industry. Especially in the public charging service market, as of the end of 2022, my country’s public charging pile operator market concentration ratio CR[2]3 is 53.7%, CR5 is 69.8%, and CR10 is 86.3%.

Data source: China Electric Vehicle Charging Infrastructure Promotion Alliance

Figure 4 The top ten operators in terms of number of public charging piles in my country (as of August 2023)

In the field of battery replacement, the high concentration of operators is even more prominent. As of the first half of 2023, my country has built a total of 2,266 power swap stations, of which 1,543 are owned by NIO, accounting for 68%; Aodong New Energy and Bertan Technology, which ranked second and third, own 615 and 615 power swap stations respectively. 108, accounting for 27% and 5% respectively.

As of September 15, 2023, NIO has built a total of 1,805 power swap stations across the country, with a total of 28 million power swaps, and an average of 60,000 power swaps per day. This means that on average, a vehicle departs from the battery swap station with a full battery every 1.44 seconds.

As mentioned in the previous section, charging infrastructure is an asset-heavy operation industry. During the construction period, enterprises need to make large-scale and long-term capital investment, and profits are relatively weak. This requires operators to have strong capabilities in capital, operations, branding, etc. strength. At the same time, as the scale of charging stations continues to expand, load fluctuations during electric vehicle charging will have a certain impact on the operation of the power grid. In order to ensure the safe operation of the power grid, power grid companies often limit the number and power of charging piles built in certain areas, which also allows first entrants to gain a certain degree of “monopoly”.

Based on the above factors, leading operators and “old players” with longer qualifications have obvious first-mover advantages, and the Matthew Effect of industry development will become increasingly intensified.

3. Challenges faced by the development of electric vehicle charging facilities

1. The construction of charging facilities involves the management of multiple entities, there are certain difficulties in departmental coordination and management

In our country, the construction of charging infrastructure involves the jurisdiction of multiple departments. This “multiple” management model has made coordination and management between departments more difficult to a certain extent, and has caused development problems such as unclear responsibilities, weakening policy effectiveness, and increasing business operating costs.

For example, the problem of “difficulties in building piles” for people in residential areas often appears in local news columns, triggering social controversy. Many electric car owners often find out that there are not enough spare capacitors in the community parking lot to install charging piles until they ask the car company’s charging pile installers to inspect the community after buying the car. It often costs millions of yuan to increase the capacity of the power grid. It is difficult for car owners, property developers or developers to bear the huge expenses. Therefore, car owners can only go out to find charging parking spaces, which greatly reduces the car experience.

In fact, in addition to increasing the capacity of the power grid, the installation of charging piles in the community may also involve many issues such as unbalanced allocation of parking spaces, fire safety, path planning, etc., which requires the cooperation of multiple departments such as community property management, power grid companies, charging facility operators, and safety supervision. Only with a certificate can successful installation be possible. This complicated process has almost eliminated the possibility of charging at home for many car owners living in old communities.

At present, the nature of the land used for charging pile construction has not been clearly defined, and its construction has not been included in the city’s overall construction land planning, laying hidden dangers for the development of the industry. Public charging piles in my country are mostly built in public areas or parking lots, and the land is mostly commercial land so that electric vehicle owners can easily access them. However, the lease period of commercial land is generally within 10 years. Compared with the average investment return period of 5 to 9 years in the charging infrastructure industry, although the lease can be continued to be renewed, it will inevitably cause considerable pressure on investors and is not conducive to the project. long-term stable operation.

The “Guiding Opinions on Further Building a High-Quality Charging Infrastructure System” issued by the General Office of the State Council clearly requires that various departments should strengthen coordination and promote “local governments at all levels to establish development and reform, energy, transportation, natural resources, industry and information It is a collaborative promotion mechanism for charging infrastructure construction that closely cooperates with relevant departments such as culture, housing and urban-rural development, commerce, fire rescue, and urban management.”

2. Inconsistent standards for charging piles and power batteries hinder the large-scale development of the industry

With the deepening of integrated layout, although many car companies are trying to cover the entire industry chain with their business scope, in fact, in the field of power batteries, except for BYD, which can produce and use it by itself, other new energy car companies are in different situations. To some extent, outsourcing is required. Affected by factors such as vehicle model design, technical route, capacity specifications, interface methods, etc., my country’s power battery market has shown a diversified development trend. At the same time, there are many different types, different specifications, and different performance power battery products, which has greatly increased the inventory and inventory of battery companies. Cost pressure also hinders the development of charging pile companies to a certain extent.

At present, my country’s battery standards are not unified, mainly reflected in three aspects. First, charging interface standards are not unified. Currently, there are five standard interfaces in the international charging pile field, namely the Chinese standard based on GB/T 20234, the North American standard CCS1 of J1772, the European standard CCS2 of IEC 62196, the Japanese standard of CHAdeMO and the Tesla standard of NACS, which are applicable respectively. In different countries and regions, there are obvious differences in interfaces, communication protocols and certification requirements. The car charging interface and charging pile equipment must match or use a conversion connector before they can be used. At present, our country has put forward a clear requirement for new energy charging interfaces sold in China, that is, the charging interface of new energy vehicles must meet the GB/T2015 interface standard. However, many imported or joint venture brand electric vehicles are being bought home by Chinese car owners. In the future, there will still be incompatibility or incompatibility with the “local pile”, which will affect the car owner’s car use and charging experience.

Second, power battery standards are inconsistent. Affected by vehicle types, technical routes and other factors, electric vehicle power batteries vary greatly in terms of dimensions, fixation methods, capacity specifications, energy density, etc. Only the “Power Battery Product Specifications and Dimensions for Electric Vehicles” released in 2017 stipulates There are as many as 145 battery models in China. With the continuous innovation of battery technology, new products are still being rapidly iterated, which has greatly increased the procurement costs of car companies and the operating pressure of the entire industry chain.

Unified battery standards are not just the unification of industry specifications. The key lies in the complete disclosure of power battery parameters of each company.

For example, the “square-circle debate” about the shape of power batteries involves not only the external shape of the battery, but also the expansion ratio and impedance ratio of the battery after being stressed (cylindrical batteries can evenly distribute force on the entire shell surface, while square-shell batteries Due to force dispersion, sufficient space must be left for the chemical substances inside to expand). For another example, from the basically unified lithium iron phosphate battery in the early years, to the ternary lithium battery with higher energy density, to BYD’s new generation of lithium iron phosphate battery that has greatly improved the energy density through innovative design and GAC Aian’s latest The launch of nano-sponge silicon anode batteries is inseparable from the extensive efforts made by car companies in technology research and development to improve battery performance and enhance product market competitiveness.

Under this circumstance, it is definitely not a goal that can be achieved through simple guidance through the release of policies to allow various car companies to disclose the parameters of their own power batteries, completely break down technical barriers, and give up the exclusive selling points of their products.

Third, standards related to charging facilities need to be standardized. For many years, in the field of charging facility manufacturing in my country, national standards and corporate standards have coexisted, and various companies have different production standards. For example, the current standards and regulations implemented in my country’s charging pile industry can be divided into three types: national standards, National Energy Administration standards, and State Grid standards. Charging pile manufacturers have national power companies, new energy vehicle companies, and high-tech companies. The three types of enterprises have derived relatively different production standards. In addition to manufacturing differences in hardware, on the user side, the charging standards of third-party charging platforms such as Te Laidian and Xingxing Charging, which are currently mainstream, are actually different, which often causes problems for users in calculating electricity costs. As the development of the charging pile industry continues to accelerate, the standardization and standardization of charging facilities has become a key step before the entire industry can achieve large-scale application, which is of great significance for accelerating the development of the industry.

The battery replacement industry faces the same development difficulties. Due to the inconsistent standards of power batteries of various manufacturers, the specifications of power batteries vary. Usually, each battery swap station can only serve a specific vehicle brand, which to a certain extent results in idle resources and increases the operating costs of the battery swap station.

Generally speaking, promoting the unification of battery size, interface, protocol and other standards is the key to promoting the rapid development of the electric vehicle industry. By unifying battery standards, the interchangeability and versatility of batteries can be improved, allowing electric vehicles of different brands and models to share charging/swapping facilities and achieve more convenient energy replenishment services. This will greatly improve the user experience and effectively enhance the practicality and convenience of electric vehicles.

3. The ratio of charging facilities to vehicles and piles is out of balance, and the demand gap continues to widen

As the penetration rate of new energy vehicles continues to increase and government support continues to increase, my country’s charging pile industry is achieving rapid growth. As of 2022, there are 5.21 million electric vehicle charging piles in my country, a year-on-year increase of 99.1%, of which 2.197 million public charging piles are in existence, a year-on-year increase of 91.6%. At the same time, from 2018 to 2022, the number of domestic electric vehicle charging piles surged from 777,000 to 5.21 million, leading the world in development scale and speed.

While the scale of development continues to rise, there is a phenomenon that is attracting more and more attention from people in the industry, that is, the vehicle-to-pile ratio is seriously imbalanced, and the development of charging piles is difficult to meet the development needs of electric vehicles.

Judging from the data alone, as of the end of 2022, the vehicle-to-pile ratio in our country is 2.7:1, and the public vehicle-to-pile ratio is 6.4:1. This number is not bad. However, in fact, this also includes charging stations that some operators built out of order in remote areas in order to obtain subsidies in the early stages of construction, some “zombie piles” that are no longer usable due to poor operation and maintenance, and some with backward technology and poor charging power. Lower “fool pile”. At the same time, the over-concentration of public charging piles in economically developed areas has also made charging piles in third- and fourth-tier cities, towns, and rural areas even more difficult to find. Therefore, the demand gap for domestic charging piles actually far exceeds market expectations. According to the development goals previously proposed by the Ministry of Industry and Information Technology of “achieving a vehicle-to-pile ratio of 2:1 in 2025 and a vehicle-to-pile ratio of 1:1 in 2030”, my country’s charging infrastructure industry still has a lot of room for effort.

Currently, in order to encourage the industry to accelerate development, many places across the country have introduced different types of subsidy measures for the construction of charging infrastructure. In the first eight months of this year alone, 15 provincial-level administrative regions introduced relevant policies to support the construction of charging piles. Among them, it not only includes phased development goals, but also issued targeted policies in many places to guide the industry from “emphasis on construction” to “emphasis on use”.

At the same time, some operators will also choose to upgrade previously built slow charging piles to fast charging piles through technological upgrades to attract more car owners. Although this transformation can significantly improve the utilization rate of charging piles, because the renovation cost of each slow charging pile is as high as more than 10,000 yuan, some operators whose construction locations are too remote and whose expected payback period is too long still consider costs. They will not choose to transform and upgrade, but are willing to maintain slow charging until they are completely eliminated by the market.

4. New energy vehicles going to the countryside, charging pile application scenarios, and supporting services still need to be improved

In recent years, the popularity of new energy vehicles from economically developed areas to rural areas has continued to accelerate. Just for the new energy vehicles going to the countryside, its market sales increased from 397,000 vehicles in 2020 to 1.068 million vehicles in 2021, and doubled again to 2.6598 million vehicles in 2022. The market scale continues to expand. At the same time, under the guidance of relevant national policies, multiple charging service platforms have vigorously promoted their business to enter rural areas. For example, China Southern Power Grid’s charging service coverage rate in the five southern provinces of Guangdong, Guangxi, Yunnan, Guizhou, and Hainan has exceeded 90%. , a total of nearly 4,000 township charging stations and nearly 20,000 charging piles have been built.

While the pace of development continues to accelerate, compared with urban areas, the development of charging facilities in rural areas of my country also faces many problems such as limited market space and lagging development of supporting services.

Rural people have more homes and courtyards, so they can have charging conditions at home, and the average power distribution capacity of 2.7 kVA per household has also met the power demand of slow charging piles. Under this circumstance, private slow charging has naturally become the first choice for rural new energy car owners who are relatively sensitive to electricity prices. This situation results in very limited development space for public charging piles, and it is difficult to guarantee profit margins. In order to expand the market, many charging service providers hope to achieve market expansion of rural public charging facilities by taking advantage of new scenarios and new business formats of rural economic development after on-site surveys.

At present, rural B&Bs that are blooming all over my country are regarded as an important force in promoting rural economic development and have also become a new platform for the development of public charging facilities in rural areas. Tourists who choose B&Bs as a resting place during their travels mostly drive there by car. They can use the entire night to recharge their batteries without placing too high demands on the charging time. In this case, the investment cost of building slow charging piles in B&Bs with relatively low investment costs can basically be recovered in just 2 to 3 years after deducting operating costs such as electricity bills. This operating model will not put too much cost pressure on B&B owners, but can also effectively expand the rural public charging pile market, providing an excellent way to open up the charging pile market in rural areas.

In June 2023, Zhidianlai, a company jointly established by the charging service brand Nenglian Zhilian and the homestay industry Internet platform Order Lai, officially launched the “One City in One Month, One Hundred Stations in One City” campaign, planning to provide services to each city More than 100 B&Bs provide charging service solutions to help rural areas achieve “full county coverage” of new energy vehicle charging stations and “full township coverage of charging piles. As of the end of June, Smart Electricity has arrived in its first city, Huzhou. The layout of charging piles in more than 100 homestays has made a positive contribution to promoting regional rural revitalization.

The relatively weak construction of power grid facilities has also become a major pain point in the development of charging infrastructure in rural areas. It is understood that the power of ordinary household charging piles is generally 7 kilowatts, which is roughly equivalent to the total power of 6 to 7 air conditioners. This means that if a car owner wants to fully charge his electric car, the home power grid needs to bear the load equivalent to 6 to 7 air conditioners running at the same time for about 7 hours. As the proportion of new energy vehicles in rural areas continues to rise, if dozens, hundreds or even thousands of vehicles are charging simultaneously in the same area, it will greatly increase the electrical energy load on the power grid and have an impact on the safe and stable operation of the power grid. At present, power access in rural areas is relatively limited, power grid capacity planning is relatively small, public transformers often cannot meet development needs, and many do not have enough expansion space, and the distribution network improvement capacity is very limited. Moreover, the consolidation and improvement of rural power grids not only involves large-scale capital investment, but also requires overall planning and advance layout of local power grids, which is difficult to achieve in a short period of time. In addition, the connection of a large number of loads will also increase the risk of electrical safety hazards such as user grounding, wire quality, and electric shock accidents.

In addition to hardware facilities, rural areas also have certain shortcomings in software services. For example, compared with cities, the population distribution in rural areas is relatively dispersed and individual villages are smaller. This distribution feature makes it difficult for charging station operators to provide complete and complete charging services. Under the same market size, more operation and maintenance personnel are needed to meet service needs, which not only squeezes the profit margins of public charging facilities, but also affects the car experience of new energy vehicle owners to a certain extent. Currently, some rural areas are exploring the creation of a “village-to-village” development model through market-based means to build a basic network that can serve a wider range of areas, thereby improving the level of regional charging services and providing more abundant electric energy to promote rural development.

4. Development Trend of Electric Vehicle Charging Facilities

1. Improve single pile utilization and innovate service models become the key to improving profitability

Compared with overseas charging operators, my country’s charging industry has developed relatively late. The main source of profit is the collection of service fees, and the business model is relatively simple. In order to improve profitability, in recent years, my country’s charging operators have also continued to explore, refine electricity fee standards and innovate value-added service models to add more sources of profit.

The key to quickly improving profitability is to increase the utilization rate of single piles. The relatively low utilization rate of charging piles can be described as a major pain point in the commercial development of public charging piles in my country. A multi-pronged approach is needed to break the development bottleneck.

On the one hand, investors need to be more rational and no longer “build where there is land” when selecting site locations. Instead, they should choose core locations and around traffic arteries, keep charging service fees as low as possible, and even provide free charging. The preferential policy for charging parking fees and the strategy of “small profits but quick turnover” are adopted to attract more car owners to come and charge.

On the other hand, according to charging data released by charging pile operators, there will be obvious peak and valley periods in the use time of public charging piles. Some operators can launch a “time-of-use charging” scheme to guide car owners who are more sensitive to electricity prices. Off-peak charging extends the overall usage time of charging piles and increases the overall utilization rate.

According to industry estimates, when the national average service fee per kilowatt hour of electricity is 0.6 yuan, a 1.9% increase in utilization can significantly shorten the two-year dynamic investment return cycle and have a significant effect on improving operators’ profitability.

The fixed power of traditional charging piles will lead to a very low actual utilization rate of high-power charging equipment when charging low-battery capacity vehicles. Using flexible charging pile technology, all or part of the charging modules of electric vehicle charging stations are gathered together, and the charging modules are dynamically allocated in real time according to the actual charging power of electric vehicles, which can effectively break the bottleneck of fixed power and improve the discharge per unit time of charging piles. It can also achieve the goal of improving the utilization level of equipment by shortening the charging time.

Generally speaking, the core advantage of flexible charging pile technology is not only to maintain the charging equipment in the optimal load range at all times and effectively improve the utilization rate of charging piles; it can also meet higher power charging needs by upgrading the charging pile and reduce repeated increases. Necessity of follow-up investment to reduce investment costs.

In the long term, if you want to improve the profitability of the charging facility industry, you need to enrich revenue channels and innovate business operation models.

In recent years, many operators have actively explored the new model of “charging piles + value-added services”, which has led to an increase in profitability. Among them, value-added services not only include traditional services such as vehicle maintenance and transportation rental, but also begin to extend to new areas such as charging pile insurance and advertising. For example, some operators continue to collect and analyze customer information through mobile apps, customize customer portraits, and push customized services such as food and shopping based on the analysis results. Some operators will also install displays directly on charging piles and invite brands to advertise, thereby increasing the profit margins of charging piles by collecting advertising revenue.

2. Integrated optical, storage, charging and discharging stations may provide new opportunities for the development of charging stations

While the development prospects are promising in the industry, the construction speed of charging piles continues to accelerate, which also greatly increases the possibility that high-power charging will have an impact on the security of the power grid. In particular, the rapid increase in the construction proportion of high-power fast charging piles has placed a considerable burden on the operation of the power grid. In this case, when building charging facilities and building an energy storage system at the same time, it can effectively adjust the load power and reduce the impact of real-time load changes on the power grid. Currently, integrated optical, storage, charging and discharging stations that can achieve an effective balance between charging services and safe operation of the power grid are regarded by the industry as an effective way to accelerate the healthy and orderly development of the charging infrastructure industry.

The core structure of the integrated photovoltaic storage, charging and discharging station consists of four parts: photovoltaic power generation, energy storage batteries, charging piles, and reverse charging. The principle is to use the power of the photovoltaic power generation module to prioritize the load demand of the charging station. This system will store excess electricity during peak photovoltaic generation periods and release the stored electricity from the energy storage battery to meet charging needs during evening load peaks.

As early as November 2020, the General Office of the State Council issued the “New Energy Vehicle Industry Development Plan (2021-2035)” which clearly stated that “encouraging more ‘photovoltaic storage charging and discharging’ (distributed photovoltaic power generation – energy storage system – charging and discharging) “Construction of integrated functional website”. Since then, the multi-functional integrated station for optical storage, charging and discharging has been mentioned many times in official occasions by relevant persons in charge of the Ministry of Industry and Information Technology and other departments, and has received more and more attention in the industry. In February 2023, the Ministry of Industry and Information Technology, the National Energy Administration and other eight departments jointly issued the “Notice on Organizing the Pilot Zone for the Comprehensive Electrification of Public Sector Vehicles”, which will “accelerate the integration pilot of ‘optical storage, charging and discharge'” “Application” is listed as one of the key tasks to guide the industry to accelerate the innovative application of new technologies and new models.

From the perspective of power operation, the integrated optical storage, charging and discharging station forms a small microgrid through the electrical connection of the core modules. To a certain extent, it can realize auxiliary service functions such as peak shaving and valley filling, and significantly reduce the load caused by fast charging stations. The peak-valley difference effectively reduces the impact on the power grid during high-power charging and improves the operating efficiency of the power grid.

From an economic point of view, first of all, by building small microgrids, not only can we achieve “self-production and sales” of clean electricity, but the integrated optical storage, charging and discharging stations with spare capacity can also sell excess electricity to the grid to earn additional income. , to improve profitability; secondly, installing a photovoltaic power generation system on the roof of an integrated station can double the value of land within a fixed area and create an echelon utilization scenario of power batteries, greatly reducing the initial investment scale of the project and effectively shortening the charging station investment return cycle.

It should be noted that at present, due to the construction cost of integrated optical storage, charging and discharging stations, which are affected by factors such as high battery costs, small peak-to-valley price differences, and low cycle performance, they face the dilemma of large initial investment and low profitability. In the future, it is necessary to further accelerate the iterative innovation of battery technology and promote the expansion and promotion of time-of-use electricity price policies. Only then can integrated optical storage, charging and discharging stations show obvious advantages and achieve large-scale commercial application.

At present, the development model of integrated optical storage, charging and discharging stations has been promoted in many places across the country, and many companies such as Tesla, Xiaomi, Triad, Xiangshan Co., Ltd. have launched optical storage, charging and discharging related technology product layouts. Among them, Tered’s optical storage, charging and discharging microgrid solutions have been applied in more than 100 cities including Beijing, Shanghai, Shenzhen, Tianjin, Chongqing, etc., and more than 200 microgrid charging stations have been built, achieving integration with multiple networks. , provincial and prefecture-level control centers. In the future, integrated optical storage and charging stations are expected to continue to increase their market share.

References:

[1] Hu Long, Wang Zhihui, Tan Jieren. Analysis of profit model and economic benefits of electric vehicle charging facilities [J]. Electrical Technology and Economics, 2020(05):55-59.

[2] Natural Resources Defense Council, China Electric Vehicles Association of 100. Optimized solutions for the construction and operation of electric vehicle charging infrastructure – taking Shanghai as an example [R]. https://finance.sina.com.cn/tech/ roll/2023-08-29/doc-imzivaup9550913.shtml, 20230829.

[3] Yin Zhongshu, Huang Shuaibin, Chen Wuji. Charging pile industry research report: demand policy resonance, electric vehicle charging pile boom in the next period [R]. https://baijiahao.Baidu.com/s?id=1769109866584624126&wfr=spider&for=pc,20230619.

[4] Zhou Ce, Yang Xin. Special report on charging pile industry: Electrification drives demand, and equipment and operators are expected to benefit [R].https://new.qq.com/rain/a/20230908A01AIJ00, 20230908.

[5] Zhu Tong. Give full play to the driving role of charging infrastructure investment to promote high-quality development [J]. China Development Observer, 2023(01):56-62.